kentucky sales tax on vehicles

For Kentucky it will always be at 6. Since Kentucky sales tax is simply 6 of the total purchase price estimating your sales tax is simple.

Kentucky S Car Tax How Fair Is It Whas11 Com

In the excise tax category the following changes were made.

. It is levied at 6 percent and shall be paid on every motor vehicle used in Kentucky. In the state of Kentucky they are considered to be exempt from the general sales and use tax so long as the motor vehicle usage was tax paid. Kentucky has a 6 statewide sales tax rate but also has 209 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 0008.

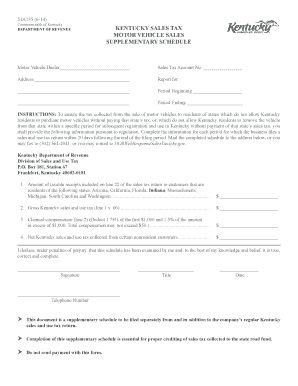

Claimed compensation line 2 Deduct 175 of the first 1000 and 15 of the amount in excess of 1000 with a 50 cap. What codes are used on a. Kentucky Sales and Use Tax is imposed at the rate of 6 percent of gross receipts or purchase price.

16 2022 To help Kentuckians combat rising prices due to inflation brought on by the global pandemic Gov. 500 Exemption from use tax of property subject to sales or gasoline tax. Allows residents of Kentucky to remove the vehicle from that state within a specific period for subsequent registration and use in Kentucky without payment of that states.

If sales tax is due the clerk collects 6 of the sales price and forwards a copy of the completed form with the other weekly mail sent to Frankfort. There are no local sales and use taxes in Kentucky. Sales and Use Tax Laws.

An expansion of the 1 state transient room tax. 505 Refundable credit of portion of sales tax paid on interstate business communications service. To ensure the tax collected from the sale of motor vehicles to residents of states which do not allow Kentucky residents to purchase motor vehicles without paying that.

1 The lease or rental of motor vehicles which are for use on the. Are services subject to sales tax in Kentucky. Motor Vehicle Property Tax Motor Vehicle Property Tax is an annual tax assessed on motor vehicles and motor boats.

This applies to a vehicle 25 years old or older and not in a roadworthy condition. Gross Kentucky sales and use tax line 1 x 06. The state of Kentucky does not usually collect sales taxes on the many services performed but in 2018 passed laws broadening the base of.

Of course you can also use this handy sales tax calculator to confirm your. Kentucky collects a 6 state sales tax rate on the purchase of all vehicles. Payment shall be made to the motor vehicle owners County Clerk.

In addition to taxes car purchases in Kentucky may be subject to other fees like registration title. That the property leased will be used in an exempt manner under the sales and use tax law. Andy Beshear announced today that he is.

The tax is collected by the county clerk or other officer with whom the vehicle is required to be registered. The vehicle can come into Kentucky on an out-of. The vehicle cannot have been previously titled in KY.

Multiply the vehicle price before trade-ins but after. Any vehicles which are not. The use tax works in conjunction with the sales.

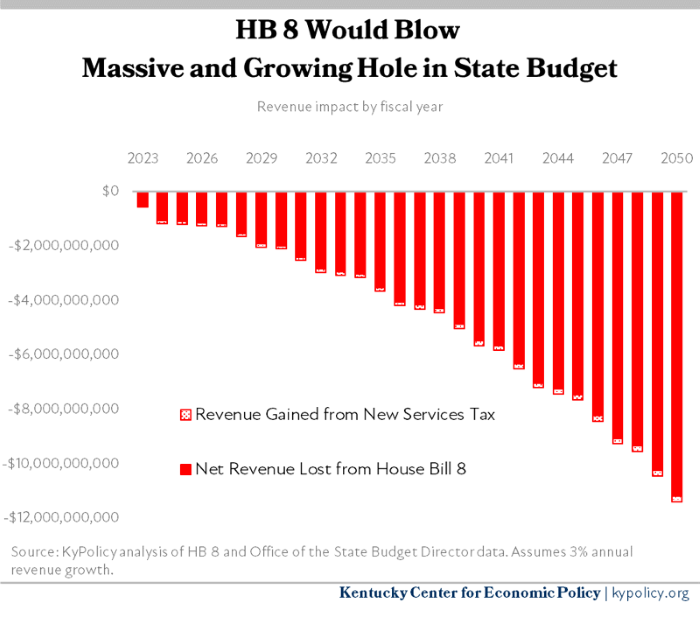

To calculate the sales tax on your vehicle find the total sales tax fee for the city andor county. Kentucky businesses must collect a 6 percent sales tax on certain services and retail sales of digital property and tangible personal property. The bill also creates andor amends several sales and use tax exemptions.

Kentucky Ford Dealer Ford Cars Trucks Suvs In Stock

Used Nissan Car Sales Bowling Green Ky Great Deals On Used Cars Trucks And Suvs In Kentucky

Nj Car Sales Tax Everything You Need To Know

Kentucky Motor Vehicle Bill Of Sale Form Templates Fillable Printable Samples For Pdf Word Pdffiller

Free Kentucky Vehicle Bill Of Sale Form Pdf Formspal

House Tax Bill Would Devastate Kentucky S Budget For A Giveaway To The Wealthy Kentucky Center For Economic Policy

Gov Beshear Pitches Sales Tax Decrease To Fight Inflation In Kentucky

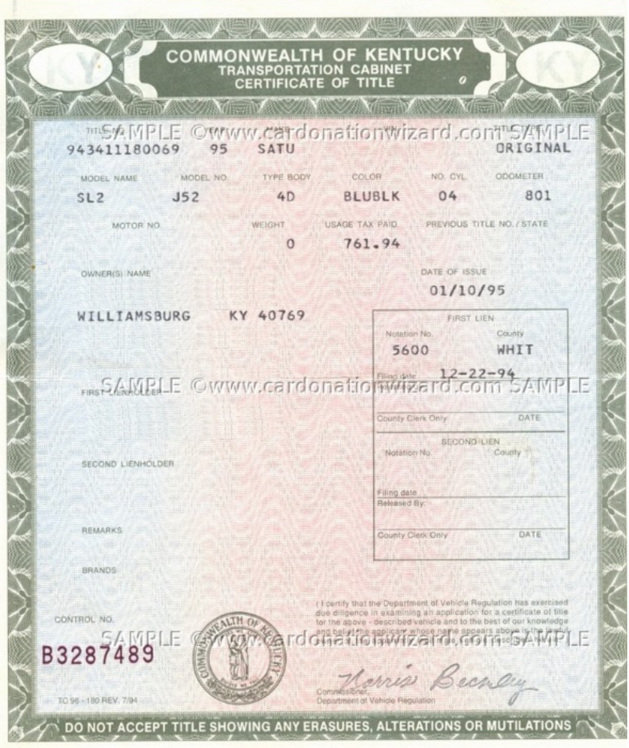

Lease To Ownership Madison County Clerk S Office

Sales Taxes In The United States Wikipedia

Car Tax By State Usa Manual Car Sales Tax Calculator

Kentucky Vehicle Sales Tax Fees Calculator Find The Best Car Price

Motor Vehicle Taxes Department Of Revenue

Kentucky Auto Dealer Bond A Comprehensive Guide For Insurance Agents

/cloudfront-us-east-1.images.arcpublishing.com/gray/JUZ2KZZWSJCPROGM5BW5AE4OHE.jpg)

Gov Beshear Provides Vehicle Tax Relief Proposes Temporary Cut In State Sales Tax

Perry S Auto Sales Inc Shelbyville Ky

Form 51a270 Fillable Certificate Of Sales Tax Paid On The Purchase Of A Motor Vehicle